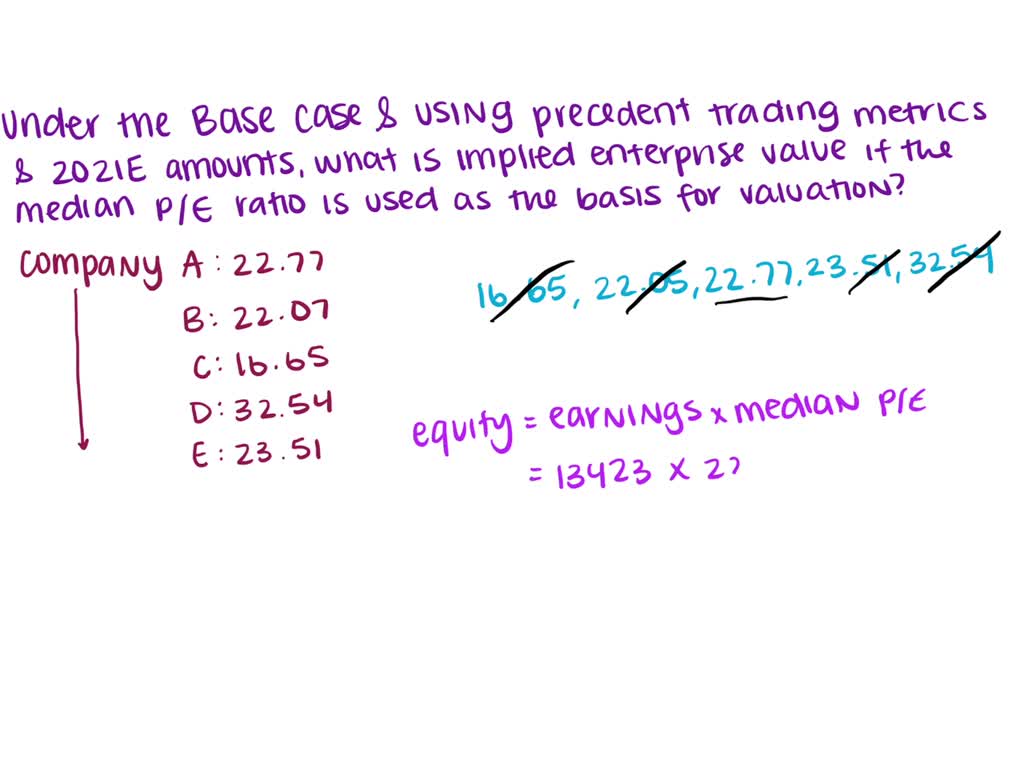

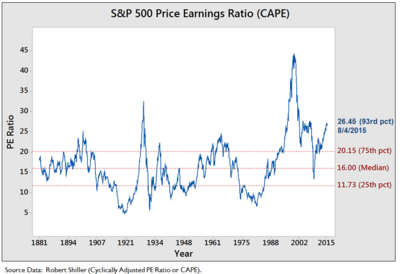

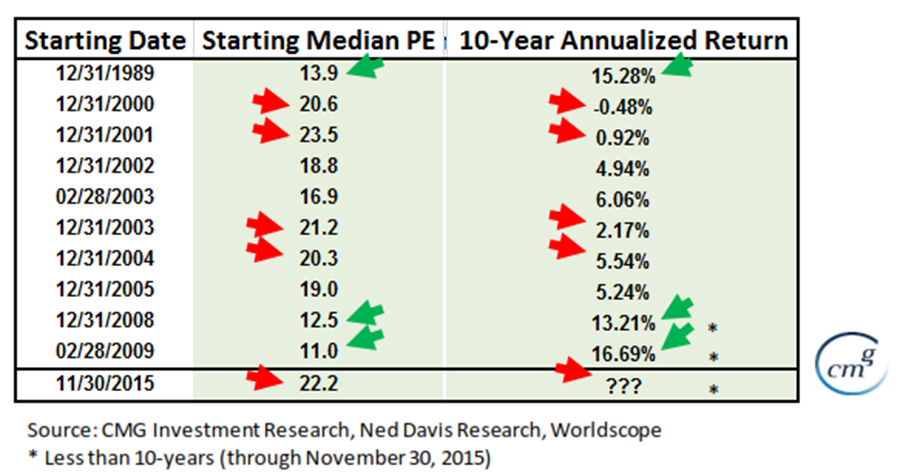

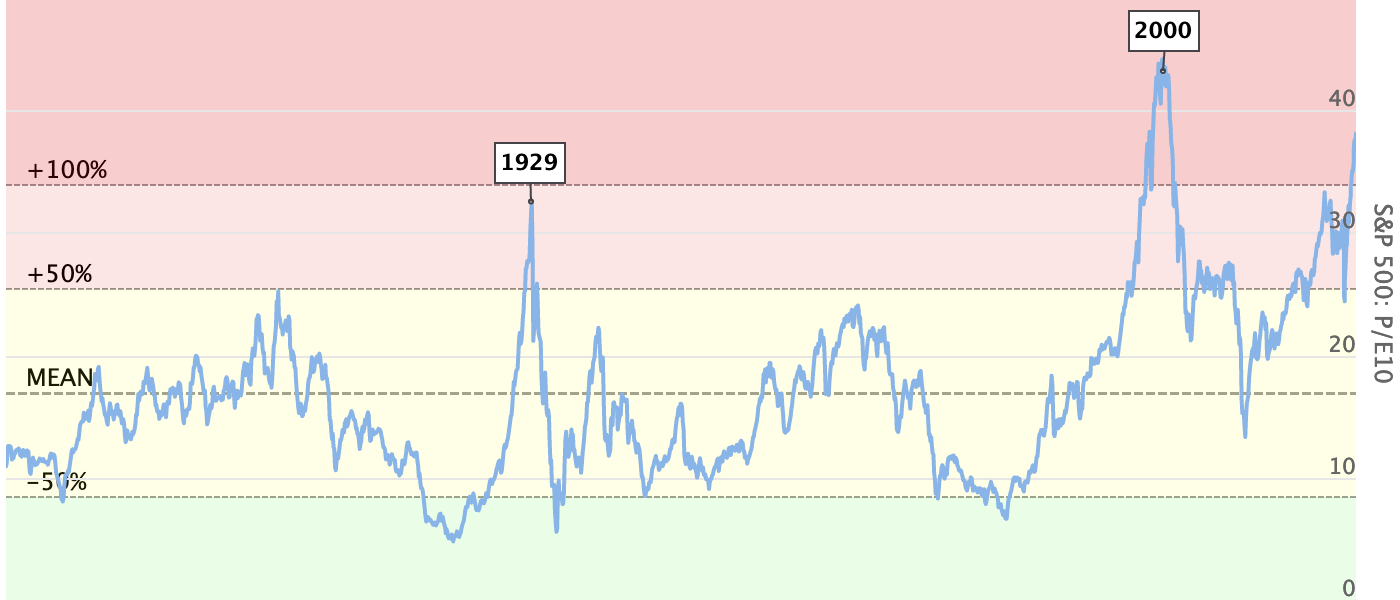

Markets & Mayhem on Twitter: "Welcome to the most expensive "new bull market" we've ever seen. The current Shiller PE ratio is 29.24 The mean is 17 and median 15.91. Most bottoms

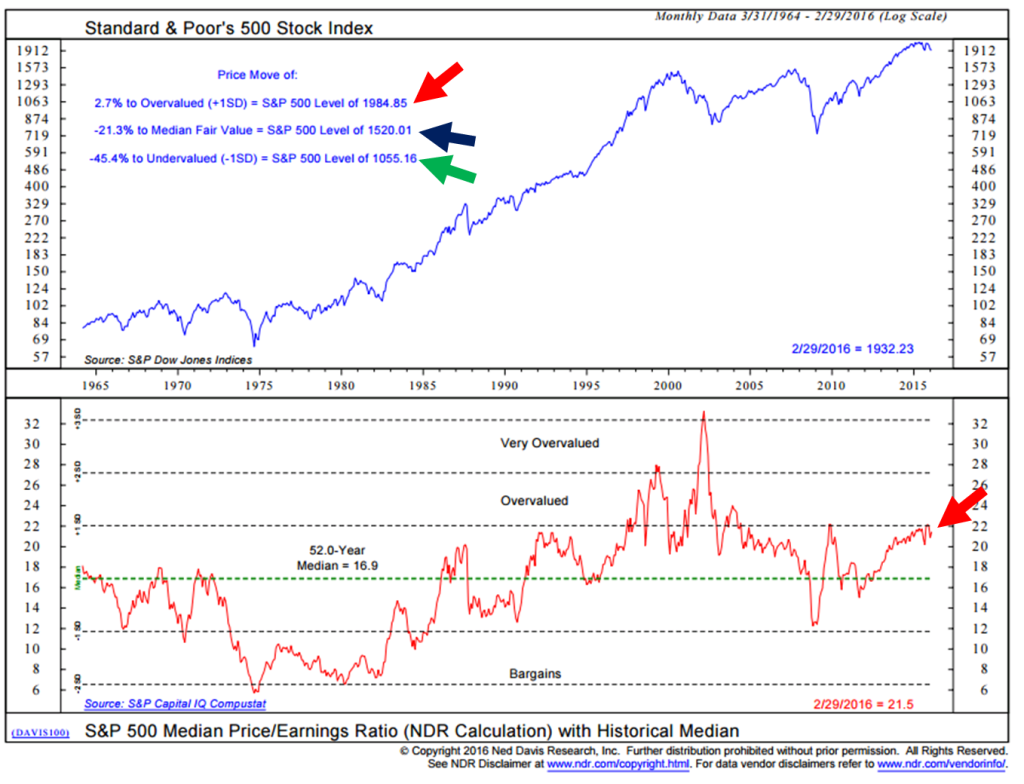

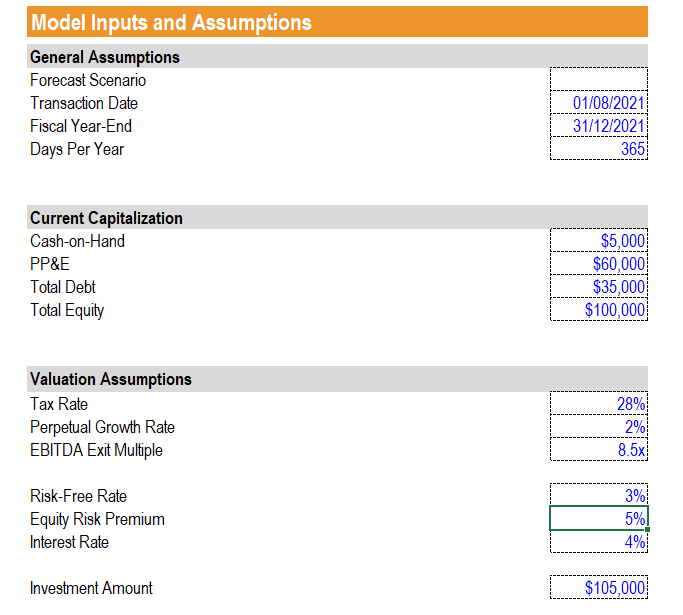

Otavio (Tavi) Costa on Twitter: "The median P/E ratio of the top 10 largest stocks in the US is now as high as it was at the peak of the Tech Bubble.

:max_bytes(150000):strip_icc()/PEG-Ratio_Final_4191448-6df4ad0f7a2842bb86915ba99293a23e.jpg)

![PDF] Relationship between Firm's PE Ratio and Earnings Growth Rate | Semantic Scholar PDF] Relationship between Firm's PE Ratio and Earnings Growth Rate | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/7c02ff72f28edd0a7eff00b70943ea81042eeb9d/12-Table2-1.png)

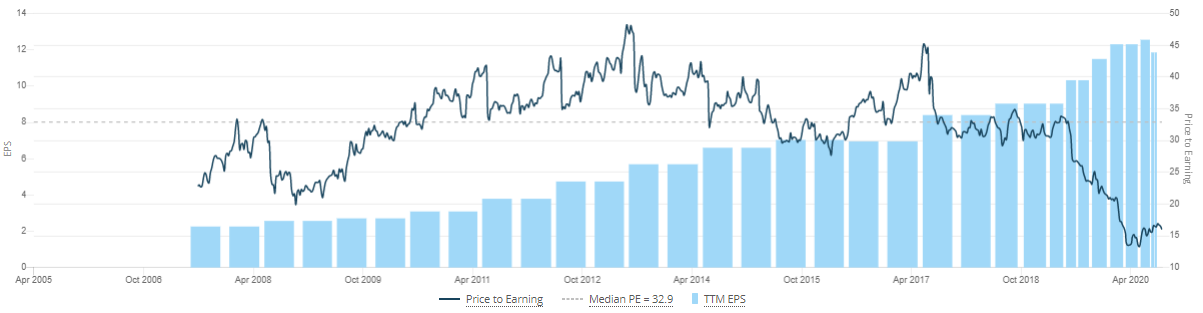

![S&P 500] Average Valuation Multiples by Industry: P/E, P/FCF, P/S, P/B, PEG S&P 500] Average Valuation Multiples by Industry: P/E, P/FCF, P/S, P/B, PEG](https://eor7ztmv4pb.exactdn.com/wp-content/uploads/2022/05/pe-ratio-sp-historical.png?strip=all&lossy=1&w=2560&ssl=1)